Makro i sektorske analize koje vam pomažu u pametnom i utemeljenom donošenju odluka.

Zlato do kraja 2026. može i do 5.000 USD/unc

30.12.2025 12:10

Impresivnih +28% prinosa za tržišta u razvoju

29.12.2025 17:32

Rast u 2025. otporan ali neujednačen

26.12.2025 11:05

Produktivnost u regiji raste, ali presporo

10.11.2025 10:35

Filteri

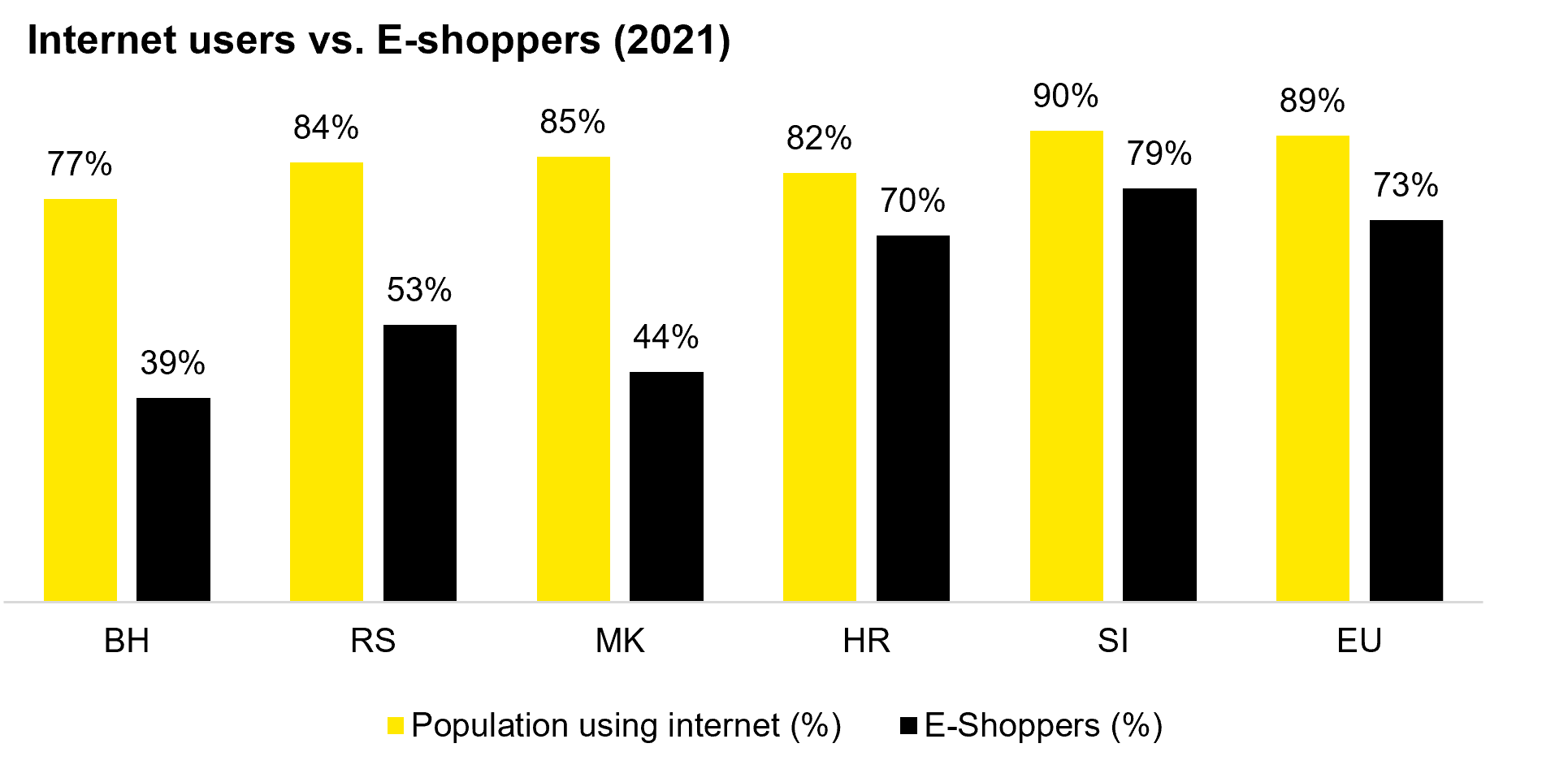

E-commerce industry - Intensifying marketplace competition

E-commerce value has grown rapidly over the past years, with the industry’s growth in mid-teens leading to changes in patterns of traditional retail and distribution business as well. E-commerce development in the Adria region is in somewhat different stages, which comes from different degree of digitalization, characteristics of the market and different economic development between the countries.

20.02.2023.

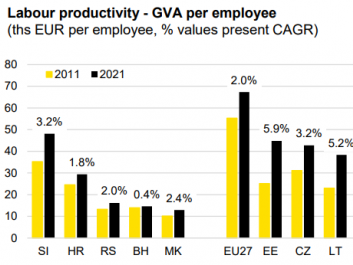

Competitiveness report - Competitiveness craving for unpopular decisions

With 20+ years of transition and convergence behind, we are taking a detailed look into the competitiveness developments of Adria countries vs. CESEE peers. Aside from highlighting competitiveness rankings made by third party centers in areas such as business environment, we are also going through high level macro results reflecting competitiveness basics.

20.02.2023.

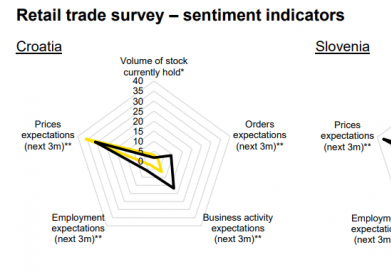

Retail trade - Retail trade trends tilted downwards

A mix of economic activity slowdown, falling real wage levels, rising interest rates and ever-increasing prices, pushed annual growth rates down significantly in Serbia, Slovenia and Croatia, further deepened the decline in North Macedonia, while still held up in Bosnia and Herzegovina.

13.02.2023.

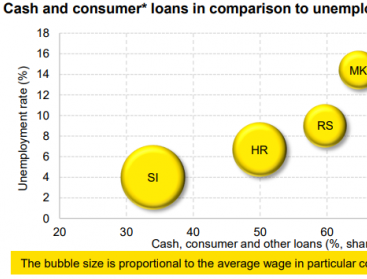

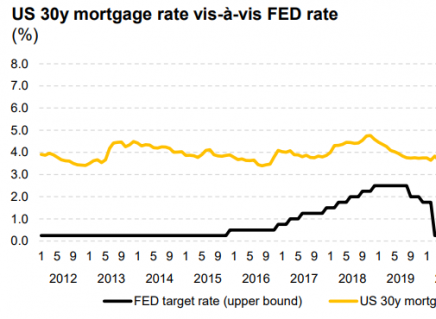

Lending activity - Lending activity slowing down, higher interest rates halting demand

In Adria region, lending activity is in the positive zone in terms of yoy growth, however in most cases growth is slowing in H2 2022. Even though monetary policies are tightening, the transmission on the interest rates still needs to fully materialize, with interest rates still allowing for demand for certain credit categories to remain strong.

08.02.2023.

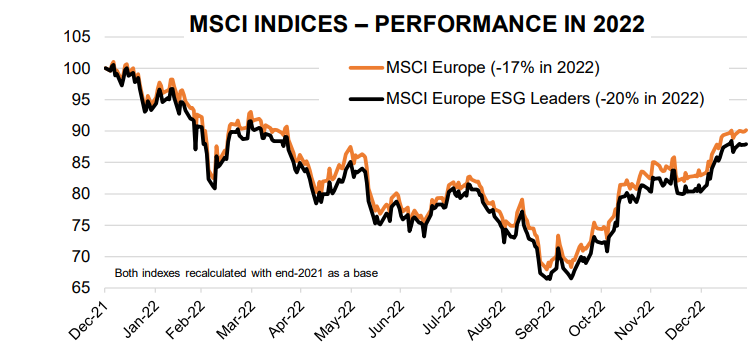

ESG report - ESG potential high in SEE

ESG is a topic increasingly becoming important for the capital flows. Global stock indexes started the year on a positive tone, with the support largely coming from the idea that most of negative elements in terms of macro fundamentals is already priced in.

06.02.2023.

Construction and real estate - Real estate cycle at turning point?

Construction activity has been slowing down in North Macedonia, Bosnia and Herzegovina and Serbia, growing in Croatia and booming in Slovenia in 2H2022. Downtrend in countries with weaker numbers is already mirroring anticipation of subdued demand due to pandemic savings fading out and rising interest rates reflecting on funding.

01.02.2023.

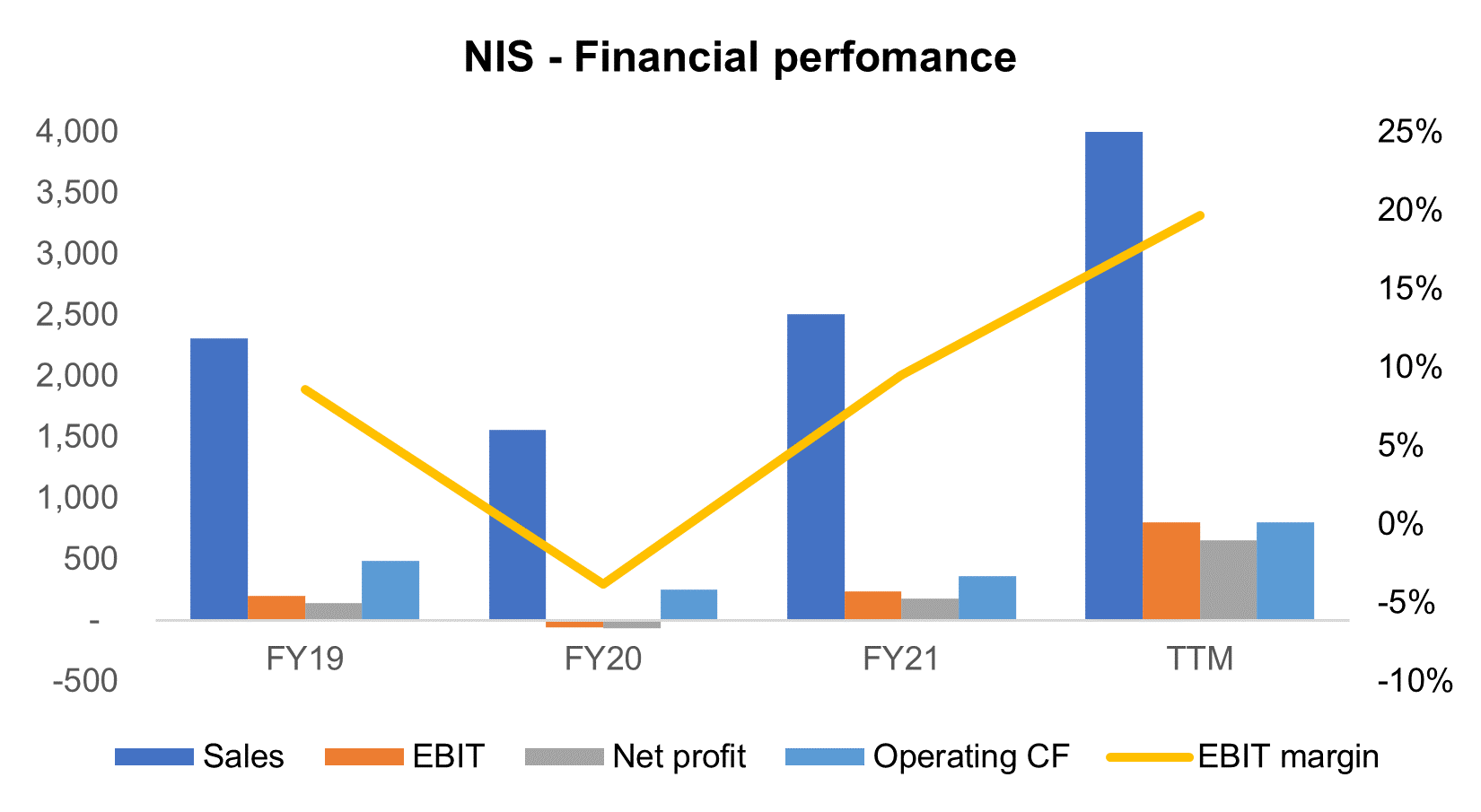

Naftna Industrija Srbije - Golden age for oil refineries

NIS performance in the recent period was highlighted by stronger sales and profitability figures on the back of higher global oil prices. We see the latter somewhat lower on average for 2023, suggesting a drop in NIS’ top and bottom line, however these key P&L elements will still remain strong. In terms of M&A activity, there is a potential for buyouts of smaller market participants in the retail segment, perhaps also in the neighbouring countries.

31.01.2023.

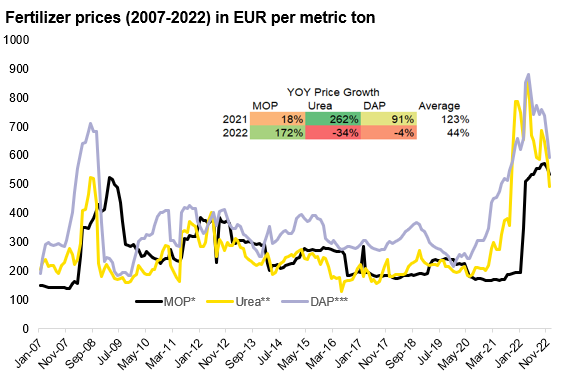

Agrochemicals – another factor behind more expensive groceries

The analysis focuses on the factors driving agrochemical prices up, especially in 2021 and 2022. The price plateau at the beginning of 2023 reflects weak underlying demand as farmers cut back fertilizer use due to affordability and availability issues. In the peer analysis section, we analyse the performance of Adria players as well as some of the largest global agrochemicals producers, in order to offer context in this volatile industry.

26.01.2023.